- Home-icon

- શૈક્ષણિક સમાચાર (Educational News)

- _ઓનલાઈન શિક્ષણના વિડીયો (ONLINE EDUCATION VIDEOS)

- __ધોરણ 1 (ધોરણ ૧)

- __ધોરણ 2 (ધોરણ ૨)

- __ધોરણ 3 (ધોરણ ૩)

- __ધોરણ 4 (ધોરણ ૪)

- __ધોરણ 5 (ધોરણ ૫)

- __ધોરણ 6 (ધોરણ ૬)

- __ધોરણ 7 (ધોરણ ૭)

- __ધોરણ 8 (ધોરણ ૮)

- __ધોરણ 9 (ધોરણ ૯)

- __ધોરણ 10 (ધોરણ ૧૦)

- __ધોરણ 11 (ધોરણ ૧૧)

- __ધોરણ 12 (ધોરણ ૧૨)

- _Primary School (પ્રાથમિક શાળા સમાચાર)

- _Paripatra (ઉપયોગી પરીપત્રો)

- _Std 1 to 12 Text Books (ધોરણ ૧ થી ૧૨ના પાઠયપુસ્તકો)

- _LEARNING OUTCOMES (અધ્યયન નિષ્પતિઓ)

- _CCC EXAM MATERIALS (સીસીસી પરીક્ષા મટેરિયલ)

- નોકરી સમાચાર (JOBS NEWS)

- _Latest Jobs (નોકરીની હાલની જાહેરાતો)

- _MATERIALS (મટેરિયલ)

- _Call Letters/ Hall Tickets (કોલ લેટર /હોલ ટીકીટ)

- _ANSWER KEY (આન્સર કી)

- _Results (રીઝલ્ટ)

- HEALTH TIPS (આરોગ્ય હેલ્થ ટિપ્સ)

- LATEST ANDROID APPS (એન્ડ્રોઇડ એપ્લિકેશનનો ખજાનો)

- GOVERNMENT SCHEMES (સરકારી યોજનાઓ)

- ગુજરાતી વેબસાઈટ

Ticker

6/recent/ticker-posts

New Eligibility for PLI (Postal Life Insurance)

New Eligibility for PLI (Postal Life Insurance)

Eligibility Criteria For PLI Policy.

Do you know the new eligibility for PLI (Postal Life Insurance) rules? Many of us unaware that Post Office also offers the Life Insurance. However, the eligibility is restricted earlier. Due to the huge competition, recently they changed the rules.

What is PLI (Postal Life Insurance)?

PLI (Postal Life Insurance) is exactly like any Life Insurance company, for example, LIC or ICICI Pru Life Insurance. The only difference is, it is run and managed by Post Office. PLI currently offers only traditional plans. Therefore, no term insurance or ULIPs. The policies are offered by Government Of India through Post Office.

The advantage of PLI is that they offer you the products at the cheaper premium with high bonus rates.

Currently, PLI offers 6 types of policies and they are as below.

Whole Life Assurance (SURAKSHA)

Convertible Whole Life Assurance (SUVIDHA)

Endowment Assurance (SANTOSH)

Anticipated Endowment Assurance (SUMANGAL)

Joint Life Assurance (YUGAL SURAKSHA)

Children Policy(BAL JEEVAN BIMA)

Advantages of investing in PLI (Postal Life Insurance)

You can avail of the tax benefits by investing in PLI under Sec.80C.

The premium you pay towards PLI is very low compared to other Life Insurance Companies premium rate (inclusive of LIC).

PLI offers the highest bonus rate (more than LIC plans).

Facilities like – Assignment, Loan, Conversion, Surrender and Paid Up Value options are also available.

You can transfer the policy to any Circle within India, at no additional charges.

PLI provides you the passbook facility to track the payment of premium and in case of loan transactions, etc.

You can pay the premium annually, half-yearly and monthly basis.

You can avail 1% discount on the premium if you make an advance premium payment for a policy period of 6 months.

You can avail 2% discount on the premium if you make an advance premium payment for a policy period of 12 months.

Nomination facility is also available.

New Eligibility for PLI (Postal Life Insurance)

A reader commented in my blog post about the new eligibility for PLI. However, I was also unaware of the same. Finally, he sent the Government notification in this regard. Hence, thought to update the same.

Let me give you the list of eligibility for PLI as per old rules and they are as below.

Central Government

Defense Service

Para-Military forces

State Government

Local Bodies

Government-aided Educational Institutions

Reserve Bank of India

Public Sector Undertaking

Financial Institutions

Nationalized Banks

Autonomous Bodies

Extra Departmental Agents in Department of Posts

Employees Engaged/ Appointed a Contract basis by central/ State Government where the contract is extendable

Employees of all Scheduled Commercial Banks

Employees of Credit Co-operative Societies and other Co-operative Societies registered with Government under the Co-operative Societies Act and partly or fully funded from the Central/ State Government/RBI/ SBI/ Nationalized Banks/ NABARD and other such institutions notified by Governmen

Employees of deemed Universities an educational institutes accredited by recognized bodies such a National Assessment and Accreditation Council, All India Council of Technical Education, Medical Council of India etc.

The insurance industry in India has undergone transformational changes after liberalization of the insurance industry in the year 2000, subsequent to setting up of the IRDA.

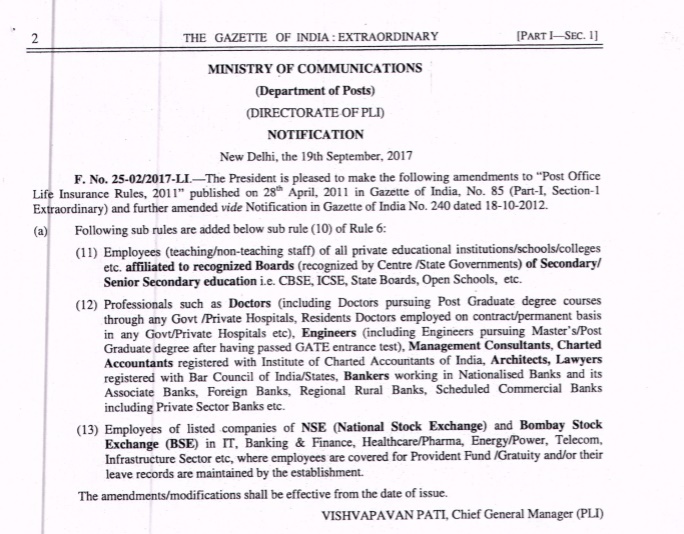

In such a competitive life insurance industry scenario, PLI felt it necessary to open the doors of eligibility for other individuals also. Hence, they came up with the notification on 18th October 2017. Sadly, the PLI portal still refers to the old eligibility rules. Below is the Government notification of the same.

Based on the above list, I am sharing you the below new eligibility for PLI (Postal Life Insurance) rules as below.

Central Government

Defense Services

Para-Military forces

State Government

Local Bodies

Government-aided Educational Institutions

Reserve Bank of India

Public Sector Undertakings

Financial Institutions

Nationalized Banks

Autonomous Bodies

Extra Departmental Agents in Department of Post

Employees Engaged/ Appointed a Contract basis by central/ State Government where the contract is extendable

Employees of all Scheduled Commercial Banks

Employees of Credit Co-operative Societies and other Co-operative Societies registered with Government under the Co-operative Societies Act and partly or fully funded from the Central/ State Government/RBI/ SBI/ Nationalized Banks/ NABARD and other such institutions notified by Governmen

Employees of deemed Universities an educational institutes accredited by recognized bodies such a National Assessment and Accreditation Council, All India Council of Technical Education, Medical Council of India etc.

Employees (teaching or non-teaching staff) of, all private educational institutions/schools/colleges etc. affiliated to recognized Boards (recognized by Centre / State Governments) of Secondary / Senior Secondary education i.e. CBSE, ICSE, State Boards, Open Schools, etc

Professionals such as Doctors (includingDoctorspursuing Post Graduate degree courses through any Govt/Private Hospitals,Residents Doctorsemployedon contract/ permanent basis in any Govt/PrivateHospitalsetc),Engineers (including’ Engineers pursuing Master’s /’ Post·Graduate degree after having passed GATE entrance test), Management Consultants; Chartered Accountants (registered with Institute orCharteredAccountantsofIndia),Architects, Lawyers (registered with Bar Council of India/ States ), Bankers (working in Nationalised and its Associate Banks,Foreign Banks,Regional Rural Banks,Scheduled Commercial Banks including Private Sector Banks) etc.

Employees of listed companies of NSE (National Stock Exchange) and Bombay Stock Exchange (BSE) in IT, Banking & Finance, Healthcare/ Pharma, Energy/power, Telecom, Infrastructure Sector etc, where employees are covered for Provident Fund./ Gratuity and / or their leave records are maintained by the establishment.

I have bolded the new eligibility for PLI (Postal Life Insurance) categories in bold. Do remember that as proof of profession, the copy of the relevant educational degree from a recognized institution / regulatory body will be submitted at the time of purchasing.

GOOGLE AD

Contact form

Labels

- 11-12 science

- 1BHK HOME PLAN

- 2BHK HOME PLAN

- 360 VIEW

- 3BHK HOME PLAN

- 4BHK HOME PLAN

- 5G NETWORK

- 7th Pay Committee

- 8th CENTRAL PAY COMMITTEE

- 8th CPC

- AADHAR CARD

- adharcard

- ADHARDISE

- ADHYAYAN NISHPATIO

- ADMISSION

- ADSENSE

- AEI

- AFFILIATE MARKETING

- After Std 12th???

- age limit

- AGRICULTURE

- AI

- AIRTEL SCHEME

- ALL NEWS PAPERS

- AMAZON

- AMUL

- Android App

- Answer Key

- ANTI VIRUS APP

- APAAR CARD

- APAARCARD

- APL LIST

- APMC

- Application to Gov

- APPRENTICESHIP

- ARTICLE 35A

- ARTICLE 370

- ARTIFICIAL INTELLIGENCE

- ASTROLOGY

- ATM

- AUDIO

- AVAILABLE SEATS

- AYODHYA CASE

- AYURVEDIC

- Baby Names

- bad

- BAL SHRUSHTI MAGAZINE

- BALVATIKA

- BANK

- BAOU

- BIRDS VOICE

- bisag

- BLO

- Blue Print

- BOOK

- BPL LIST

- BSF

- BSNL

- BUDGET

- BUSINESS NEWS

- Calculators

- CALENDAR

- call letter

- Call Letters

- CAMPAIGN

- CAR ON RENT IN INDIA

- CASH BACK

- cbse

- CBT

- ccc

- CCC EXAM MATERIAL

- CCC+

- CCE

- Central Government

- CET

- CGL

- CGPA

- CHARGER

- CHAT GPT

- CIRCULAR

- CISF

- CLAT

- Clerk

- CMAT

- CNG

- COAST GUARD

- Computer

- CONSTITUTION

- CORONAVIRUS

- COURT

- CPF

- CRC-BRC

- CREDIT

- CRICKET

- CRPF

- CRYPTO CURRENCY

- CTET

- CURRENCY

- current

- CYCLONE

- D.EL.ED.

- DA

- DAILY CURRENT AFFAIRS

- DAYARO

- DEBIT CARD

- DEFENCE

- DEPARTMENTAL EXAM

- DEVOTIONAL

- DGVCL

- Dictionary

- DIGITAL GUJARAT

- Digital India

- Digital Locker Service

- DIKSHA APP

- DIPLOMA

- Disaster Management

- DISE CODE

- DISTANCE LEARNING

- DIVYANG

- DOCUMENT VERIFICATION

- DONATE CAR TO CHARITY CALIFORNIA

- DRAWING

- Driving licence

- E-MAGAZINE

- EARN MONEY ONLINE

- EBC

- Eclipse

- ECONOMICS

- Education Department

- education of Out States

- EDUCATIONAL NEWS

- EDUSAFAR

- ele

- ELECTION

- ELECTRIC EQUIPMENT

- ELECTRIC VEHICLES

- english

- EPF

- ESSAY

- EXAM DATE

- excel

- EXTERNAL EDUCATION

- FEE PAYMENT

- FEE REFUND

- Festival

- fic

- FILE

- FINAL ANSWER KEY

- Finance Dept

- FIT INDIA

- fix pay

- FIXED DEPOSIT

- FLIPKART

- FLN

- FLOOD

- font

- FOREST

- form

- G-SHALA APP

- GAD

- GADGET

- game

- GAS

- GATE

- GCERT

- GEOGRAPHY

- GEOMETRY

- geovernment scheme

- GET DAILY MESSAGE

- GETCO

- GHARE SHIKHIYE

- GHIBLI IMAGE

- Gift City

- GIRNAR PARIKRAMA

- Gk

- GMAIL

- Gold-Silver Price

- government Employees

- government scheme

- GPAT

- GPF

- GPS

- GPSC

- GPSC DAILY UPDATES

- GPSSB

- GR

- GRADE PAY

- GRADUITY

- GRAMMAR

- GRANT

- GRAPH

- GREENHOUSE

- GSEB

- GSEBESERVICE

- GSET

- GSRTC

- gssb

- GSSSB

- GST

- GUEEDC

- GUJARAT PAKSHIK

- GUJARAT TOURISM

- GUJARAT UNIVERSITY

- gujarati

- gujcet

- gunotsav

- GYAN KUNJ

- GYAN SADHANA

- GYAN SAHAYAK

- GyanParab

- GYANSETU

- GYANSETU SCHOOL

- GYANSHAKTI SCHOOL

- HACKING

- Hair Problem

- hall ticket

- HANTAVIRUS

- HEALTH DEPARTMENT

- HEALTH TIPS

- Help Line

- HERITAGE

- HETUO

- HIGH COURT

- HIGHER PAY SCALE

- Hindi

- HISTORY

- HITESHPATELMODASA

- HMAT

- HNGU

- HOLIDAYS

- HOME LEARNING

- HOME LOAN

- HOROSCOPE

- HOSPITAL JOBS

- HOSTEL

- HOW TO

- HRA

- HSC

- HTAT

- I KHEDUT YOJANA

- IBPS

- ICDS

- ICE RAJKOT

- IELTS

- IIM

- IIT

- IJAFO

- income tax

- INCREMENT

- INDIAN AIR FORCE

- Indian Army

- INDIAN COAST GUARD

- Indian Navy

- Inspire Award

- insurance

- Internet

- interview

- INVESTMENT

- IPHONE

- IPL

- IPO

- ISRO

- ITI

- JAM

- Javahar Navodaya

- JEE

- Jilla Fer Badali

- JIO

- JIOGIGAFIBER

- job

- JRF

- JYOTISH

- KENDRIYA VIDYALAYA

- KGBV

- KHADI

- KHEDUT

- KHEL SAHAYAK

- KHELMAHAKUMBH

- KIDS

- Language

- LATEST MOBILE

- LC

- LEARNING OUTCOMES

- LIC

- LIVE DARSHAN

- LIVE TELECAST

- LOANS

- LOCKDOWN

- LOGBOOK

- LOGO

- LOKSABHA

- LPG

- LTC

- MAHABHARAT

- MAHEKAM

- MAPS

- MARI YOJANA WEBSITE

- MARUGUJARAT

- MASIK PATRAK

- MASVAR AAYOJAN

- MATDAR YADI

- MATERIAL

- Mathematics

- MATHS-SCIENCE KIT

- MATRUTVA RAJAO

- MDM

- MDRA BILL MERA ADHIKAR

- MEDIA

- medicine

- MEDITATION

- MEENA RADIO

- MERIT

- Mesothelioma

- META

- MGVCL

- MICROSOFT

- MINA NI DUNIYA

- MISSION VIDHYA

- Mob Restrict

- MOBILE

- MODEL PAPERS

- model school

- MODULE

- MONGHVARI

- MORTGAGE

- MOVIE

- MP3

- MRP

- MS UNIVERSITY

- MUSIC

- MUTUAL FUND

- My Article

- MYSY

- Nagarpalika Jobs

- NAMO LAKSHMI YOJANA

- NARENDRA MODI

- NAS

- NATAK

- National Highways

- NCERT

- NDA

- NEET

- NEP 2020

- NET

- NEW EDUCATION POLICY

- New Jobs

- NEWS

- NFSA

- NIBANDH

- NMMS

- NOKIA

- notification

- NPS

- NREGA

- NTSE

- NURSING

- OBC

- OJAS JOBS

- old papers

- OMRSHEER

- ONGC

- ONLINE ATTENDANCE

- ONLINE BILL PAYMENT

- ONLINE BOOKING

- Online Material

- ONLINE SHOPPING

- ONLINE TEACHER TRANSFER

- OROP

- PAGAR BILL

- PAN

- panchayat

- paper solution

- Pari

- PARIKSHA AAYOJAN

- PARIKSHA PE CHARCHA

- Paripatra

- Pass

- PASSPORT

- PAT

- patrako

- PAY SCALE

- PAYTM

- PEDAGOGY

- Penshan

- PERCENTILE RANK

- PET

- PETROL-DIESEL-LPG PRICE

- PFMS

- PGVCL

- PH

- PhD

- PITRUTVA RAJAO

- PM AWAS YOJANA

- PM CARES FUND

- PM Kisan Samman Nidhi

- PM WANI SCHEME

- PM YASHASVI Scolarship Scheme

- PM-JAY

- PMMVY

- PMSYM

- POEMS

- police

- POLITICAL NEWS

- Post Office

- PRADHAN MANTRI SHRAM YOGI MAN DHAN YOJANA

- pragya

- PRAPTA RAJA

- PRATIBHASHALI VIDHYARTHI

- Pravasi Shixak

- Praveshotsav

- PRAYER

- PRESS NOTE

- PRET

- PRIMARY SCHOOL

- PROVISIONAL ANSWER KEY

- PSE-SSE

- PSYCHOLOGY

- PTC

- PUC CERTIFICATE

- PUZZLES

- QR CODE

- QUIZ

- railway

- RAILWAY RECRUITMENT

- RAJAO

- RAKSHASHAKTI SCHOOL

- RAM MANDIR

- Ramayan

- RATH YATRA 2018

- RATIONCARD

- RBI

- READING CAMPAIGN

- RECHARGE

- REDMI

- Reservation

- result

- Results

- REVIEW

- REWARD

- RINGTONE

- RIP

- Rojagar

- Rojagar News Paper

- ROJNISHI

- RRB AHMEDABAD

- RTE

- RTI

- RTO

- SAINIK SCHOOL

- SALANG NOKARI

- SAMARTH

- sangh

- SANSKRIT

- SARKARI YOJANA

- SAS GUJARAT

- SBI

- SC

- SCE

- Scholarship

- SCHOOL JOBS

- SCHOOL MERGE

- SCHOOL OF EXCELLENCE

- science

- SEB

- secondary school

- SELECTION LIST

- SELL

- Service Book

- SHALAKOSH

- SHARE MARKET

- Shikshan Sahayak

- SHIXAK JYOT

- SI

- SOE

- SOFTWARE

- SOLAR ENERGY

- Song

- SPEECH

- SPELLING

- SPIPA

- SPORT

- SS

- SSA

- SSC

- STAFF SELECTION COMMISSION

- STANDARD-1

- STANDARD-10

- STANDARD-11

- STANDARD-12

- STANDARD-2

- STANDARD-3

- STANDARD-4

- STANDARD-5

- STANDARD-6

- STANDARD-7

- STANDARD-8

- STANDARD-9

- STEM LAB

- STORY

- SUBSIDY

- SUKANYA SAMRIDDHI YOJANA

- SUPREME COURT

- SURVEY

- Svachchh Bharat

- SWIFTCHAT

- syllabus

- TABLET YOJANA

- talati

- TALIM

- TALUKA FER BADALI

- TAT

- TEACHER EDITION

- Teacher Seniority List

- TEACHERS CODE

- TECHNOLOGY

- TET

- TEXT BOOKS STD: 1-12

- TIKTOK

- time table

- TOLL FREE NUMBERS

- TPEO-DPEO

- TPT

- True copy

- TV

- UGVCL

- UNIT TEST

- UNIVERSITY NEWS

- UPCHARATMAK KARYA

- UPSC

- USEFUL WEBSITES

- VAGLE

- VALATAR RAJA

- VANAGI

- VANCHAN ABHIYAN

- VANDE GUJARAT

- VASATI GANATRI

- VAVAZODU

- VI NEWS

- video

- VIDHYASAHAYAK BHARATI

- VIGYAN MELO

- VIKALP CAMP

- Vikas

- VIKRAM SARABHAI SCHOLARSHIP

- VINOD RAO

- VIRAL VIDEOS

- VIRTUAL CLASSROOM

- VITAMINS

- VOTER LIST

- WAITING LIST

- WATERPARKS

- weather

- WEATHER FORECAST

- WINDY

- WORLD CUP 2019

- WORLD'S LARGEST

- XIAOMI

- YOGA

- YOUTUBE

- हिन्दी

- ગ્રામર

- વ્યાકરણ

Ad Space

Popular Posts

Random Posts

3/random/post-list

Recent in Jobs

3/job/post-list

Popular Posts

Created By VKTemplates | Distributed By Blogger Theme Developer