- Home-icon

- શૈક્ષણિક સમાચાર (Educational News)

- _ઓનલાઈન શિક્ષણના વિડીયો (ONLINE EDUCATION VIDEOS)

- __ધોરણ 1 (ધોરણ ૧)

- __ધોરણ 2 (ધોરણ ૨)

- __ધોરણ 3 (ધોરણ ૩)

- __ધોરણ 4 (ધોરણ ૪)

- __ધોરણ 5 (ધોરણ ૫)

- __ધોરણ 6 (ધોરણ ૬)

- __ધોરણ 7 (ધોરણ ૭)

- __ધોરણ 8 (ધોરણ ૮)

- __ધોરણ 9 (ધોરણ ૯)

- __ધોરણ 10 (ધોરણ ૧૦)

- __ધોરણ 11 (ધોરણ ૧૧)

- __ધોરણ 12 (ધોરણ ૧૨)

- _Primary School (પ્રાથમિક શાળા સમાચાર)

- _Paripatra (ઉપયોગી પરીપત્રો)

- _Std 1 to 12 Text Books (ધોરણ ૧ થી ૧૨ના પાઠયપુસ્તકો)

- _LEARNING OUTCOMES (અધ્યયન નિષ્પતિઓ)

- _CCC EXAM MATERIALS (સીસીસી પરીક્ષા મટેરિયલ)

- નોકરી સમાચાર (JOBS NEWS)

- _Latest Jobs (નોકરીની હાલની જાહેરાતો)

- _MATERIALS (મટેરિયલ)

- _Call Letters/ Hall Tickets (કોલ લેટર /હોલ ટીકીટ)

- _ANSWER KEY (આન્સર કી)

- _Results (રીઝલ્ટ)

- HEALTH TIPS (આરોગ્ય હેલ્થ ટિપ્સ)

- LATEST ANDROID APPS (એન્ડ્રોઇડ એપ્લિકેશનનો ખજાનો)

- GOVERNMENT SCHEMES (સરકારી યોજનાઓ)

- ગુજરાતી વેબસાઈટ

Ticker

6/recent/ticker-posts

A Quick Guide To Post Office Monthly Income Scheme

A Quick Guide To Post Office Monthly Income Scheme.

🔹🔹ALSO READ THIS:

▶IMP MATERIAL

▶IMP CURRENT AFFAIRS

▶IMP GENERAL KNOWLEDGE

▶OLD QUESTION PAPERS

▶APPLY TO NEW JOBS

🔹🔹POMIS: POST OFFICE MONTHLY INCOME SCHEME.

🔹🔹A Quick Guide To Post Office Monthly Income Scheme(POMIS)

▶▶CLICK HERE TO READ THIS ARTICLE IN GUJARATI

Are you looking for an investment avenue which is safe and secure, earns substantial returns with a short locking period, which says no to equities and is absolutely risk free? Well then, think about investing in a Post Office Monthly Income Scheme (POMIS).

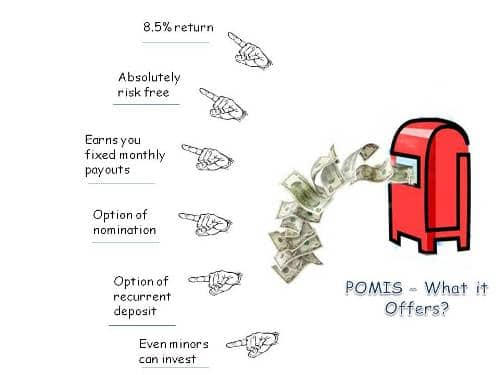

Monthly Income Scheme (MIS) is an investment scheme of Indian postal service. It promises the investor guaranteed returns at 8.5% per annum in the form of fixed monthly income. Seasoned investors consider MIS to be one of the smartest options to park funds as it gives you three merits – keeps your capital intact, yields better returns than debt instruments and assures a fixed monthly income.

Urban investors are often reluctant to make an investment in POMIS. It looks very old world but so as you know it was the post office, that introduced banking services in India and is still the largest banking service provider in the country. Being administered by the Ministry of Finance, it boasts of far greater credibility than any other form of investment.

🔹Key Features of Post Office Monthly Income Scheme

The maturity term for MIS is 5 years. Ideally, you should withdraw the amount after 5 years. At the end of the term, you’ll get back every single penny that you had invested. Needless to say, you keep getting your fixed monthly income for this whole period.

However, if you have to withdraw the money before 5 years, here’s what happens.

Withdraw the deposit within 1 year – You get nothing

Withdraw the deposit in 1 -3 years – You get your deposit back after a nominal 2% deduction (as a penalty)

Withdraw the deposit after 3 years - You get your deposit back after a nominal 1% deduction (as a penalty)

🔹How does it Works?

Making an investment in POMIS is as easy as a pie and requires minimal documentation. The investor needs to submit a copy of the address proof and identity proof (passport/PAN card/ration card/voter identity card) and passport size photographs.

To get started, the investor needs to open an account. He can opt for either an individual account or a joint account. This table below shows the minimum and maximum amount that can be invested in POMIS.

Investment AmountLower CapUpper CapSingle AccountRs 1,500Rs 4,50,000Joint AccountRs 1,500Rs 9,00,000

🔹How it works?

Mr. Sharma chooses to make an investment in MIS. He invests Rs 1,00,000 with a maturity period of 5 years. At an annual interest rate of 8.5%, he should get a fixed payout of Rs 708 every month (this figure can be summed out very easily on a POMIS calculator available online). At the end of the investment tenure, he’ll get his deposit money back.

The money can be withdrawn in two ways, either directly from post office or get it credited in your savings account through ECS. The money is usually meant to be withdrawn on a monthly basis. However, the investor can let it to accumulate over a few months and then withdraw it but it’s not of much use as the idle money will not earn you any interest.

To make POMIS more effective at yielding returns, a new feature was added to it. The investor has the option of combining it with a recurring deposit wherein the interest that you earn on a monthly basis is invested in a recurring deposit. This in turn, lets your money to grow even more money.

🔹Key Features

POMIS account is transferable from one post office to another. The best thing is that it can be done absolutely free of cost.

For every post office deposit deposit you make, a separate account has to be opened. The good thing is that one person can open ‘N’ number of accounts (of course up to the upper limit).

The maturity amount realized at the end of the term can be reinvested in POMIS.

The investor can also appoint a nominee for his POMIS account. So, in case of his unfortunate demise, his nominee becomes entitled to get his money.

The good news is that there is no TDS (Tax Deduction at Source) here to eat away your capital. The bad news is that the interests so earned are taxable.

🔹Who Should Invest in MIS?

MIS has been designed for risk-averse investors, with a big no to equity instruments, hunting for a source of fixed monthly payouts. It is most aptly suited to the needs of senior citizens and retired people who have just entered in the no-more-paychecks zone and are ready to make a onetime investment with the sole purpose of getting safe regular income so as to maintain their lifestyle. Simply put, POMIS is for those who are looking for a long term regular source of income.

🔹Who is Eligible?

The only pre-requisite is that the investor should be a resident Indian. NRIs cannot make an investment in POMIS. The best thing about this post office scheme is that the lower cap on the entry age is set at 10 years. So, even a 10 year old minor can open a POMIS account in his name. The maximum amount that a minor can invest is Rs 3,00,000.

🔹What’s Not So Good?

POMIS does not offer any tax rebate under section 80C. Simply put, the amount invested in POMIS is not tax deductible.

If the monthly payouts are not withdrawn, they sit idle and do not yield any interest.

There is no TDS on the Post Office MIS, but the interest income is taxable in your hands.

🔹How is it Different from Monthly Income Plans?

People often get confused between Monthly Income Scheme and Monthly Income Plan. To make it worse the Monthly Income Plan itself is used both in context of insurance and mutual funds. Here are the essential differences between the three. Hopefully, it’ll bust out the misconceptions once and for all.

Monthly Income SchemeMonthly Income Plan(Mutual Fund)Monthly Income Plan (Insurance)A post office investment scheme guarantees fixed monthly income at a 8.5% annual rateA debt oriented mutual fund in which the investment is made in equity-debt instruments in a 20:80 ratioA variant of retirement plan in which the annuities are paid to the insured in form of monthly incomeMonthly income is guaranteedMonthly income is not guaranteed. Rather, it depends on the returns earned for that particular periodMonthly income is fixed and guaranteed. It is created out of the nest egg of the premiums paid throughout the policy tenureTDS is not applicable. However, interest earned is taxableTDS is not applicableThe annuity paid monthly is taxableMIS suits best to those who cannot afford to bear any risk such as old aged and retired peopleMIPs are for those risk averse investors who like to stay somewhere in between the safe-but-unyielding debt funds and the risky-but-yielding equity fundsRetirement monthly income plans are for those who are looking to get the dual benefits of insurance and investmentThe locking period is just 1 year after which the investor can withdraw the money, but not without incurring 1-2% penalty chargesThe investor has to incur 1% exit load for cashing the units within 1 year of investmentThe investment tenure is quite long (as this is a long term plan) and the insured has to incur surrender charges for withdrawing the amount before the policy termThere’s a limit to the amount you can invest in POMIS (4.5 lakh for single account, 9 lakh for joint account)There’s no such limit on investment amount in MIPsNo limit on investment amountThe returns are fixed at 8.5%The returns are not fixed. They can shoot up to 14% at times or tumble down even negatively. The motive of monthly income plans is to insure and secure the capital, rather than getting the returns

🔹Revised Interest Rate

Post Office Monthly Income Scheme has faced a steep decrease in the interest rate from 8.40% to 7.80%, payable monthly. The interest rate prior to April 1, 2016 was 8.40%. Here, it is important to know that the income earned by interest through this scheme is taxable. In addition, an individual can invest maximum of Rs. 450,000 in Post Office Monthly Income Scheme. This amount includes his/her share in the joint accounts. The minimum deposit is Rs. 1500 and deposits are accepted in the multiples of Rs. 1500.

🔹Account Type

🔹Deposit Allowed (Minimum)

🔹Deposit Allowed (Maximum)

▪Single accounts

Rs. 1500/-

Rs. 450,000

▪Joint accounts

Rs. 1500/-

Rs. 900,000

🔹Here is a table that represents the New Interest Rates on Post Office Monthly Saving Scheme:

▶Scheme

▶Interest Rate | Maturity

▶Important Points

W.E.F. April 1, 2016

Prior to April 1, 2016

▶Mothly Income Scheme (MIS)

▶7.80% -8.40% | 5 years

▶Interest Income Payable

🔹The Verdict

Monthly Income Scheme is surely an effective investment tool that efficiently deploys the capital to earn guaranteed monthly income for you throughout the investment tenure. Moreover, it comes with the infallible backing of the government. No wonder, POMIS is an all time favorite among old aged, retired people and risk-averse investors.

🔹🔹A Quick Guide To Post Office Monthly Income Scheme:

GOOGLE AD

Contact form

Labels

- 11-12 science

- 1BHK HOME PLAN

- 2BHK HOME PLAN

- 360 VIEW

- 3BHK HOME PLAN

- 4BHK HOME PLAN

- 5G NETWORK

- 7th Pay Committee

- 8th CENTRAL PAY COMMITTEE

- 8th CPC

- AADHAR CARD

- adharcard

- ADHARDISE

- ADHYAYAN NISHPATIO

- ADMISSION

- ADSENSE

- AEI

- AFFILIATE MARKETING

- After Std 12th???

- age limit

- AGRICULTURE

- AI

- AIRTEL SCHEME

- ALL NEWS PAPERS

- AMAZON

- AMUL

- Android App

- Answer Key

- ANTI VIRUS APP

- APAAR CARD

- APAARCARD

- APL LIST

- APMC

- Application to Gov

- APPRENTICESHIP

- ARTICLE 35A

- ARTICLE 370

- ARTIFICIAL INTELLIGENCE

- ASTROLOGY

- ATM

- AUDIO

- AVAILABLE SEATS

- AYODHYA CASE

- AYURVEDIC

- Baby Names

- bad

- BAL SHRUSHTI MAGAZINE

- BALVATIKA

- BANK

- BAOU

- BIRDS VOICE

- bisag

- BLO

- Blue Print

- BOOK

- BPL LIST

- BSF

- BSNL

- BUDGET

- BUSINESS NEWS

- Calculators

- CALENDAR

- call letter

- Call Letters

- CAMPAIGN

- CAR ON RENT IN INDIA

- CASH BACK

- cbse

- CBT

- ccc

- CCC EXAM MATERIAL

- CCC+

- CCE

- Central Government

- CET

- CGL

- CGPA

- CHARGER

- CHAT GPT

- CIRCULAR

- CISF

- CLAT

- Clerk

- CMAT

- CNG

- COAST GUARD

- Computer

- CONSTITUTION

- CORONAVIRUS

- COURT

- CPF

- CRC-BRC

- CREDIT

- CRICKET

- CRPF

- CRYPTO CURRENCY

- CTET

- CURRENCY

- current

- CYCLONE

- D.EL.ED.

- DA

- DAILY CURRENT AFFAIRS

- DAYARO

- DEBIT CARD

- DEFENCE

- DEPARTMENTAL EXAM

- DEVOTIONAL

- DGVCL

- Dictionary

- DIGITAL GUJARAT

- Digital India

- Digital Locker Service

- DIKSHA APP

- DIPLOMA

- Disaster Management

- DISE CODE

- DISTANCE LEARNING

- DIVYANG

- DOCUMENT VERIFICATION

- DONATE CAR TO CHARITY CALIFORNIA

- DRAWING

- Driving licence

- E-MAGAZINE

- EARN MONEY ONLINE

- EBC

- Eclipse

- ECONOMICS

- Education Department

- education of Out States

- EDUCATIONAL NEWS

- EDUSAFAR

- ele

- ELECTION

- ELECTRIC EQUIPMENT

- ELECTRIC VEHICLES

- english

- EPF

- ESSAY

- EXAM DATE

- excel

- EXTERNAL EDUCATION

- FEE PAYMENT

- FEE REFUND

- Festival

- fic

- FILE

- FINAL ANSWER KEY

- Finance Dept

- FIT INDIA

- fix pay

- FIXED DEPOSIT

- FLIPKART

- FLN

- FLOOD

- font

- FOREST

- form

- G-SHALA APP

- GAD

- GADGET

- game

- GAS

- GATE

- GCAS PORTAL

- GCERT

- GEOGRAPHY

- GEOMETRY

- geovernment scheme

- GET DAILY MESSAGE

- GETCO

- GHARE SHIKHIYE

- GHIBLI IMAGE

- Gift City

- GIRNAR PARIKRAMA

- Gk

- GMAIL

- Gold-Silver Price

- government Employees

- government scheme

- GPAT

- GPF

- GPS

- GPSC

- GPSC DAILY UPDATES

- GPSSB

- GR

- GRADE PAY

- GRADUITY

- GRAMMAR

- GRANT

- GRAPH

- GREENHOUSE

- GSEB

- GSEBESERVICE

- GSET

- GSRTC

- gssb

- GSSSB

- GST

- GUEEDC

- GUJARAT PAKSHIK

- GUJARAT TOURISM

- GUJARAT UNIVERSITY

- gujarati

- gujcet

- gunotsav

- GYAN KUNJ

- GYAN SADHANA

- GYAN SAHAYAK

- GyanParab

- GYANSETU

- GYANSETU SCHOOL

- GYANSHAKTI SCHOOL

- HACKING

- Hair Problem

- hall ticket

- HANTAVIRUS

- HEALTH DEPARTMENT

- HEALTH TIPS

- Help Line

- HERITAGE

- HETUO

- HIGH COURT

- HIGHER PAY SCALE

- Hindi

- HISTORY

- HITESHPATELMODASA

- HMAT

- HNGU

- HOLIDAYS

- HOME LEARNING

- HOME LOAN

- HOROSCOPE

- HOSPITAL JOBS

- HOSTEL

- HOW TO

- HRA

- HSC

- HTAT

- I KHEDUT YOJANA

- IBPS

- ICDS

- ICE RAJKOT

- IELTS

- IIM

- IIT

- IJAFO

- income tax

- INCREMENT

- INDIAN AIR FORCE

- Indian Army

- INDIAN COAST GUARD

- Indian Navy

- Inspire Award

- insurance

- Internet

- interview

- INVESTMENT

- IPHONE

- IPL

- IPO

- ISRO

- ITI

- JAM

- Javahar Navodaya

- JEE

- Jilla Fer Badali

- JIO

- JIOGIGAFIBER

- job

- JRF

- JYOTISH

- KENDRIYA VIDYALAYA

- KGBV

- KHADI

- KHEDUT

- KHEL SAHAYAK

- KHELMAHAKUMBH

- KIDS

- Language

- LATEST MOBILE

- LC

- LEARNING OUTCOMES

- LIC

- LIVE DARSHAN

- LIVE TELECAST

- LOANS

- LOCKDOWN

- LOGBOOK

- LOGO

- LOKSABHA

- LPG

- LTC

- MAHABHARAT

- MAHEKAM

- MAPS

- MARI YOJANA WEBSITE

- MARUGUJARAT

- MASIK PATRAK

- MASVAR AAYOJAN

- MATDAR YADI

- MATERIAL

- Mathematics

- MATHS-SCIENCE KIT

- MATRUTVA RAJAO

- MDM

- MDRA BILL MERA ADHIKAR

- MEDIA

- medicine

- MEDITATION

- MEENA RADIO

- MERIT

- Mesothelioma

- META

- MGVCL

- MICROSOFT

- MINA NI DUNIYA

- MISSION VIDHYA

- Mob Restrict

- MOBILE

- MODEL PAPERS

- model school

- MODULE

- MONGHVARI

- MORTGAGE

- MOVIE

- MP3

- MRP

- MS UNIVERSITY

- MUSIC

- MUTUAL FUND

- My Article

- MYSY

- Nagarpalika Jobs

- NAMO LAKSHMI YOJANA

- NARENDRA MODI

- NAS

- NATAK

- National Highways

- NCERT

- NDA

- NEET

- NEP 2020

- NET

- NEW EDUCATION POLICY

- New Jobs

- NEWS

- NFSA

- NIBANDH

- NMMS

- NOKIA

- notification

- NPS

- NREGA

- NTSE

- NURSING

- OBC

- OJAS JOBS

- old papers

- OMRSHEER

- ONGC

- ONLINE ATTENDANCE

- ONLINE BILL PAYMENT

- ONLINE BOOKING

- Online Material

- ONLINE SHOPPING

- ONLINE TEACHER TRANSFER

- OROP

- PAGAR BILL

- PAN

- panchayat

- paper solution

- Pari

- PARIKSHA AAYOJAN

- PARIKSHA PE CHARCHA

- Paripatra

- Pass

- PASSPORT

- PAT

- patrako

- PAY SCALE

- PAYTM

- PEDAGOGY

- Penshan

- PERCENTILE RANK

- PET

- PETROL-DIESEL-LPG PRICE

- PFMS

- PGVCL

- PH

- PhD

- PITRUTVA RAJAO

- PM AWAS YOJANA

- PM CARES FUND

- PM Kisan Samman Nidhi

- PM WANI SCHEME

- PM YASHASVI Scolarship Scheme

- PM-JAY

- PMMVY

- PMSYM

- POEMS

- police

- POLITICAL NEWS

- Post Office

- PRADHAN MANTRI SHRAM YOGI MAN DHAN YOJANA

- pragya

- PRAPTA RAJA

- PRATIBHASHALI VIDHYARTHI

- Pravasi Shixak

- Praveshotsav

- PRAYER

- PRESS NOTE

- PRET

- PRIMARY SCHOOL

- PROVISIONAL ANSWER KEY

- PSE-SSE

- PSYCHOLOGY

- PTC

- PUC CERTIFICATE

- PUZZLES

- QR CODE

- QUIZ

- railway

- RAILWAY RECRUITMENT

- RAJAO

- RAKSHASHAKTI SCHOOL

- RAM MANDIR

- Ramayan

- RATH YATRA 2018

- RATIONCARD

- RBI

- READING CAMPAIGN

- RECHARGE

- REDMI

- Reservation

- result

- Results

- REVIEW

- REWARD

- RINGTONE

- RIP

- Rojagar

- Rojagar News Paper

- ROJNISHI

- RRB AHMEDABAD

- RTE

- RTI

- RTO

- SAINIK SCHOOL

- SALANG NOKARI

- SAMARTH

- sangh

- SANSKRIT

- SARKARI YOJANA

- SAS GUJARAT

- SBI

- SC

- SCE

- Scholarship

- SCHOOL JOBS

- SCHOOL MERGE

- SCHOOL OF EXCELLENCE

- science

- SEB

- secondary school

- SELECTION LIST

- SELL

- Service Book

- SHALAKOSH

- SHARE MARKET

- Shikshan Sahayak

- SHIXAK JYOT

- SI

- SOE

- SOFTWARE

- SOLAR ENERGY

- Song

- SPEECH

- SPELLING

- SPIPA

- SPORT

- SS

- SSA

- SSC

- STAFF SELECTION COMMISSION

- STANDARD-1

- STANDARD-10

- STANDARD-11

- STANDARD-12

- STANDARD-2

- STANDARD-3

- STANDARD-4

- STANDARD-5

- STANDARD-6

- STANDARD-7

- STANDARD-8

- STANDARD-9

- STEM LAB

- STORY

- SUBSIDY

- SUKANYA SAMRIDDHI YOJANA

- SUPREME COURT

- SURVEY

- Svachchh Bharat

- SWIFTCHAT

- syllabus

- TABLET YOJANA

- talati

- TALIM

- TALUKA FER BADALI

- TAT

- TEACHER EDITION

- Teacher Seniority List

- TEACHERS CODE

- TECHNOLOGY

- TET

- TEXT BOOKS STD: 1-12

- TIKTOK

- time table

- TOLL FREE NUMBERS

- TPEO-DPEO

- TPT

- True copy

- TV

- UGVCL

- UNIT TEST

- UNIVERSITY NEWS

- UPCHARATMAK KARYA

- UPSC

- USEFUL WEBSITES

- VAGLE

- VALATAR RAJA

- VANAGI

- VANCHAN ABHIYAN

- VANDE GUJARAT

- VASATI GANATRI

- VAVAZODU

- VI NEWS

- video

- VIDHYASAHAYAK BHARATI

- VIGYAN MELO

- VIKALP CAMP

- Vikas

- VIKRAM SARABHAI SCHOLARSHIP

- VINOD RAO

- VIRAL VIDEOS

- VIRTUAL CLASSROOM

- VITAMINS

- VOTER LIST

- WAITING LIST

- WATERPARKS

- weather

- WEATHER FORECAST

- WINDY

- WORLD CUP 2019

- WORLD'S LARGEST

- XIAOMI

- YOGA

- YOUTUBE

- हिन्दी

- ગ્રામર

- વ્યાકરણ

Ad Space

Popular Posts

Random Posts

3/random/post-list

Recent in Jobs

3/job/post-list

Popular Posts

Created By VKTemplates | Distributed By Blogger Theme Developer